#INVESTFOSSILFREE

Want your investments to stop financing the fossil fuel industry?

Add your voice in asking asset managers to give us all the option of investing fossil-free by filling in the form below. It will only take a minute!

Your asset manager invests on your behalf. Let them know that you want your money to profitably match your values.

You DO have a say in how the future is financed.

View all our full FFSA campaign timelines (with recent updates) and media coverage here.

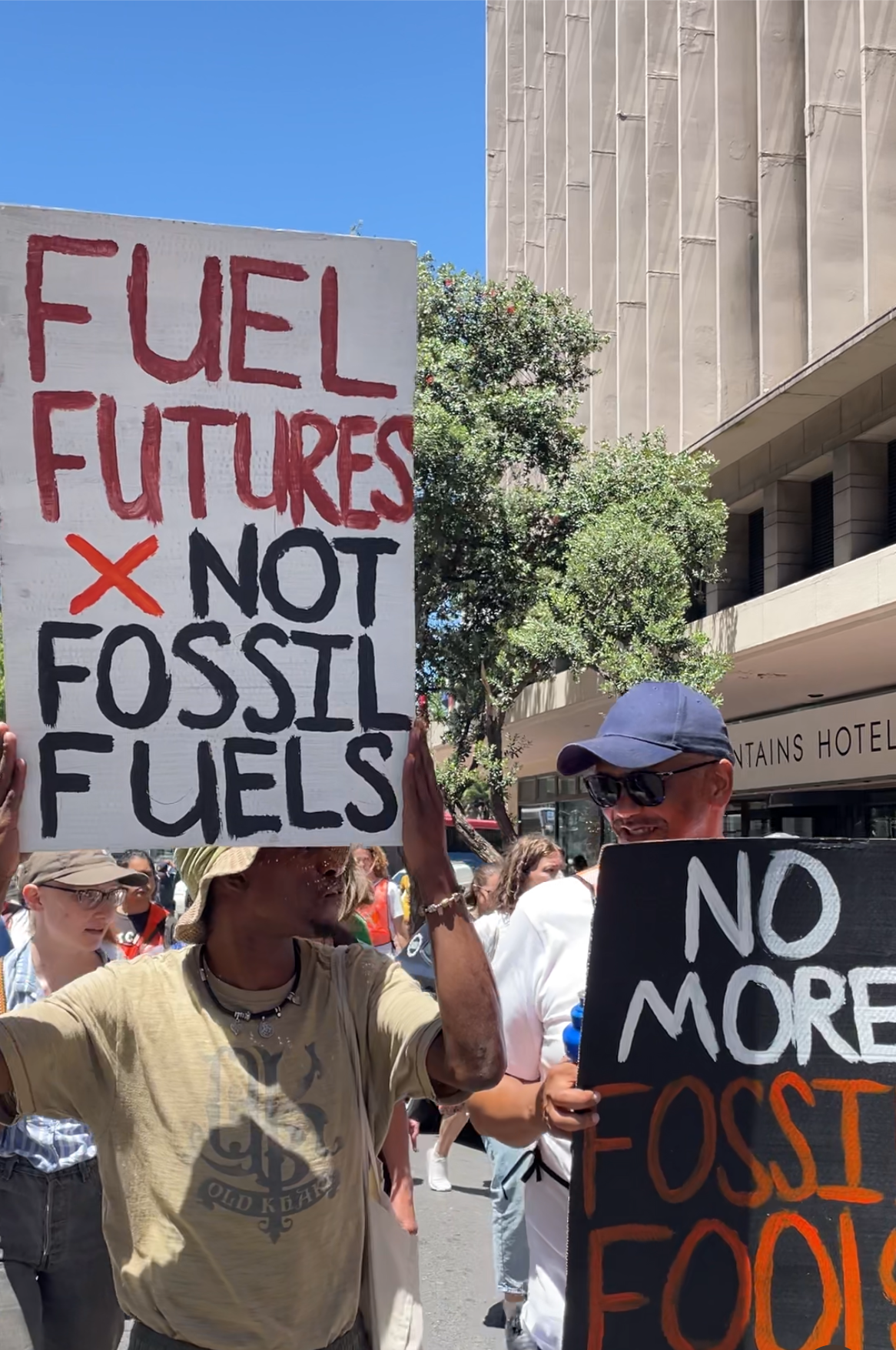

DIVEST FROM FOSSIL FUELS

·

INVEST IN THE FUTURE

·

DIVEST FROM FOSSIL FUELS · INVEST IN THE FUTURE ·

Add Your Voice

-

The Problem

Without realising it, many of us are investing in the biggest agents of climate change – fossil fuel companies – through our pensions and investments.

We’re trying to change that by building public support for funds free of fossil fuels.

Then we’ll engage with asset managers on behalf of the people who want these funds.

-

The Process

Fossil fuel divestment is a global movement calling people to withdraw their money from investments in fossil fuel companies. Over $40 trillion in endowments and portfolios are already in!

This puts pressure on fossil fuel companies contributing most to climate breakdown.

-

The Outcome

Divesting from fossil fuels frees up capital for reinvestment in safer, cleaner, and more ethical options. Divestment is hard in South Africa. But by showing asset managers there’s demand for fossil-free investments, we can change that.

We’re not asking asset managers to divest 100% overnight – just to create more fossil-free options for the many people who want them.

Upcoming events

Past events

News

Gallery

November 2024: Our Investment Justice Walk participants hearing about the City of Cape Town's divestment efforts.

November 2024: Supporters from Eco Maties and Save our Sacred Lands attending our Investment Justice Walk, where we traversed various historical sites discussing the history of ethical investment.

October 2024: Our interns at Oranjezicht Farmers Market.

October 2024: Four of our seven interns take a break from campaigning.

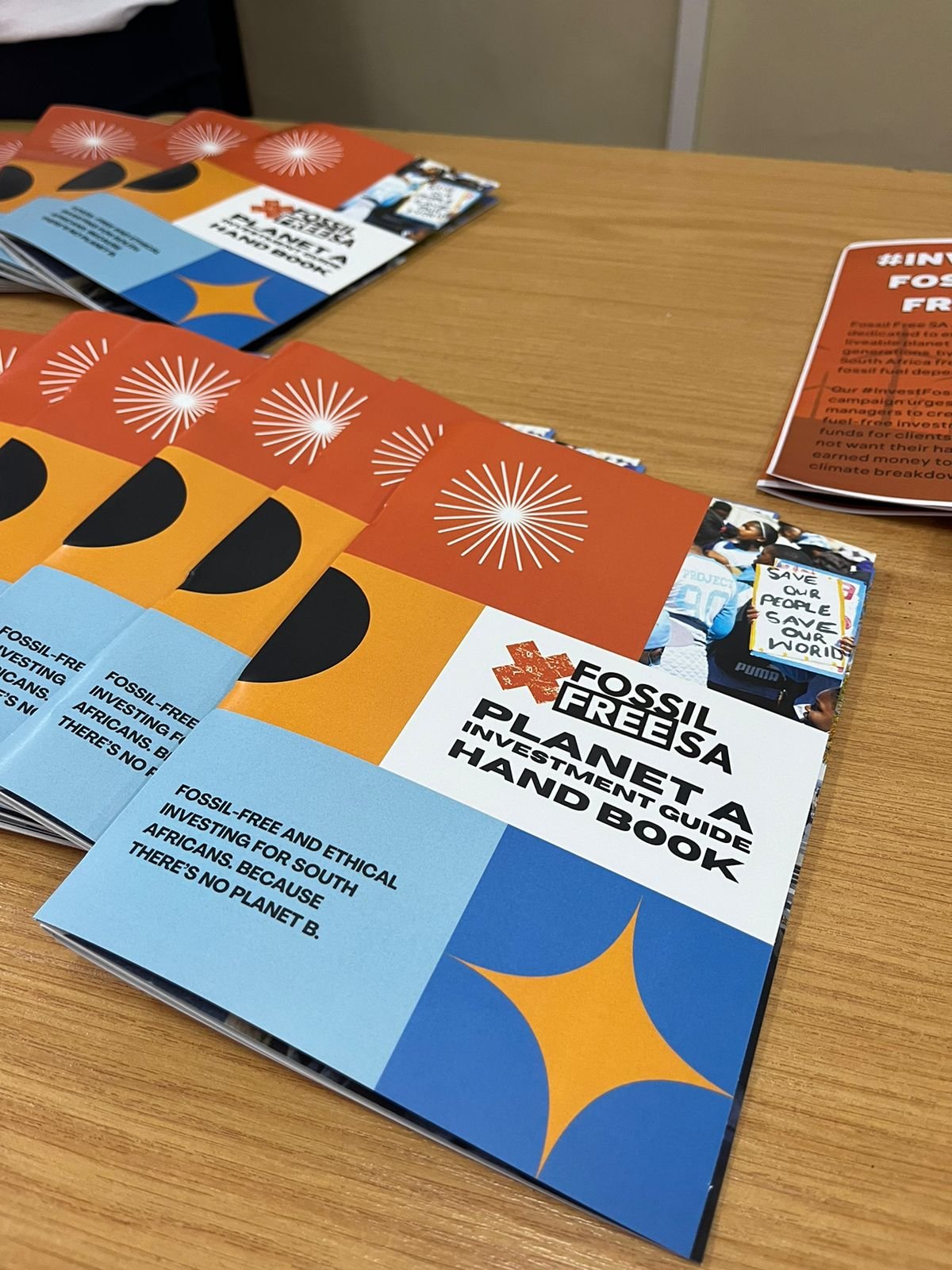

October 2024: Our Planet A Investment Guide launch event.

September 2024: The latest version of our Planet A Investment Guide Handbook was launched.

September 2024: Our new interns on their first day of campaigning.

September 2024: Our divestment campaigners, Sandrine and Steph, at African Climate Alliance's Cape Town Climate Week.

July 2024: “Life Beyond Fossil Fuels” interactive session with the Stellenbosch Sustainability Institute.

PLANET A INVESTMENT GUIDE

Practical guide for citizen investors

The latest edition is from October 2024, and comes with a handbook:

Handbook (PDF) in glorious technicolour introducing the guide and providing practical steps towards divestment. This lists only three South African funds (international funds are in the document below).

Full-length (Google doc) version, including funds available in South Africa which invest in emerging, global and offshore markets (with explanations of the differences between these categories and a host of other helpful information).

Your questions answered

-

Continued investment in fossil fuels poses the following grave risks to both investors and society at large:

Continued under-investment in the green economy needed to avert the worst dangerous climate change.

Continued social licence for an industry that has become very dangerous, exploitative and corrupt.

Continued decline or crippling of the South African economy by the negative external effects of fossil fuels: climate breakdown, missed development opportunities, economic volatility, deadly air pollution, excessive water use, continued corruption, poor governance (strongly associated with these industries) and global (the fossil-fueled Ukraine war) and regional conflict (the insurgency in Mozambique).

Loss of returns on investments due to these factors (asset stranding).

Missed opportunities for investments in the green economy.

Possible sharp loss of capital in a carbon bubble scenario.

-

Fund managers are the financial specialists who decide how most of the money you save in your retirement fund or unit trust is actually invested: e.g., how much of it goes offshore, how much is invested in bonds, how much in property, how much in which companies.

Fund managers have enormous power in society. As one SA asset manager says, asset managers “decide how the valuable savings or resources of a population are allocated for growth and development”. But at the moment, South Africa’s asset managers have effectively allocated many of our resources not for a thriving economy and healthy environment, but for a crippled economy and devastated environment. They didn’t do this maliciously or deliberately. But they’re still applying the investment logic of the 1960s when the evidence is now overwhelming that this is a recipe for disaster. Many of them are very concerned about climate themselves, but say they need you, the asset owners, to first start noisily demanding this kind of change so they can beat institutional inertia.

None of them, to our knowledge and despite their purported concern over climate change, have meaningfully educated or canvassed their clients on the issue.

Overseas fund managers do already offer many fossil-free investment options. They’re easy to find if you live in the US, UK, Europe or Australia. The world’s biggest asset manager, Black Rock, has also to some degree made addressing climate change a priority. But there are still no fossil fuel-free options for ethical and responsible South African investors. We have to change this. In the long term, all investment should be responsible (or better regulated).

So-called ESG investment can be helpful, but can also be a mass smokescreen for inaction and greenwashing. We like ESG mostly only when it leads to outright exclusion of the worst permitters.

South Africa’s biggest asset managers collectively manage over R2.7 trillion. Over 10 million South Africans participate in various forms of collective investment via savings, retirement funds and unit trusts. Even more are connected to financial services. This represents enormous potential power for creative change, if even a small proportion of this capital is redirected towards truly environmentally and socially responsible investment.

-

Of course. You have standing wherever you have money invested.

-

We’re still some way from seeing actual fossil-free funds created. It’s possible you may get lower returns, but there are many good reasons to think that fossil-free funds in South Africa can get acceptable or even improved returns. The two substantially fossil-free funds that we are aware of are delivering acceptable performance. Divesting will help protect you against stranded assets and the sharp loss of returns threatened by a possible carbon bubble.

-

Yes, we’re all still dependent on them. But we have to phase them out very fast, in favour of reduced energy demand and renewable energy sources such as wind and solar. We’re NOT asking that all fossil fuel companies shut down overnight, just that they start cutting their emissions at the speed that scientists have figured out is needed to keep average global warming below 1.5C; that is, at least 7.6% emissions reductions annually. Unfortunately, despite their claims, few if any are doing so.

The divestment movement has fostered many climate activists who have gone on to work in new arenas, such as Extinction Rebellion and Greta Thunberg’s FridaysforFuture.

The social and political nature of fossil fuel divestment (and its links to our own anti-apartheid struggle in South Africa) has been very well explained by Robert Massie, a senior advisor from Boston Common Asset Management in the US, speaking in 2015.Well, I’ve heard [this claim] that divestment is ineffective and I would like to suggest otherwise. Taking the South African case, where I wrote a 700-page book on it, it’s absolutely true it had no effect on the stock price and that’s totally irrelevant. At no point during the South African divestment or in the fossil fuel movement does anyone care about the stock price of these companies. If you look at it through finance, you see no effect and therefore you conclude that there’s been no impact. But if you look at it through the discipline of history, you see that it’s incontrovertible that step by step by step it was the South African divestment movement that changed the public discourse, that transformed the decisions of corporations to get out of South Africa and our government, led by a Republican Senate, to pass a comprehensive sanctions bill. Well, one of the things that’s fascinating about it is that climate change has been one of those problems where we’ve been hoping that someone else would do something about it. But divestment has the impact of saying, what are your direct responsibilities? If you own stock in Exxon, if you’re receiving dividends from Exxon whose business model is to destroy the planet, do you feel comfortable with that? Do you endorse what they’re doing? Normally, when you own a stock, you’re endorsing their business plan. And so instead of pushing this off to someone else, it transforms people and institutions exactly as a democracy should.

-

We’re not saying the asset managers should immediately sell off all their Sasol shares if they and most of their clients don’t want to. We’re just saying they should make it possibly for those of us who do want to divest, to do so more easily.

-

We think any credible fossil fuel-free fund also needs to exclude destructive industries such as tobacco, armaments and intensive meat production; and that all investable companies should be screened to ensure they score well for their environmental, social and governance (ESG) practices.

-

Please do connect with us and ask. We’re big on dialogue and low on judgement.

We still haven’t answered your question? Get in touch or see our divestment uber-FAQ here.